By merchantaccountholds April 16, 2025

Having your merchant account frozen is a stressful experience for any business owner. When payment processing abruptly stops, it immediately affects your cash flow and ability to conduct business. This in-depth guide will help you with the merchant account freeze. You will learn why accounts get frozen, the initial steps to take, how to fix the issue, and preventative measures for the future.

Understanding Why Merchant Accounts Get Frozen

Payment processors and merchant account providers all have strict policies regarding risk management to guard themselves, consumers, and legitimate businesses. Reasons why your account may be frozen include suspicious behavior, excessive chargeback rates, terms of service violations, compliance problems, and risk assessment changes. Payment processors track transactions constantly for anomalies that may represent fraud. A sudden influx of transactions, abnormally sized transactions, or large numbers of transactions from an atypical geographic area can lead to security warnings. These surveillance systems are set up to act in a defensive mode.

If your company has a high rate of chargebacks relative to successful transactions, processors will freeze your account as a precaution. The standard threshold in the industry is generally 1% of transactions that end in chargebacks, although this depends on the provider and the industry. Excessive chargebacks not only pose a financial threat to processors but can be indicative of problems with products, services, or business practices.

Every payment processor has its terms of service. Selling prohibited goods, misleading your business, or doing business in restricted sectors can result in account freezes. Most processors prohibit high-risk industries like adult material, gaming, pharmaceuticals, or negative option billed subscription services.

Not complying with PCI DSS (Payment Card Industry Data Security Standards) or other regulations may lead to a frozen account. These standards are in place to safeguard cardholder data and provide safe transaction processing. Not complying raises the odds of data breaches and fraud. Processors will, at times, re-evaluate the risk involved in particular business models or types of industries. This may impact your account even if your particular business has not changed its methods. Problems within an industry, like higher rates of fraud within certain industries, may cause such reassessments.

Immediate Steps to Take When Your Account Is Frozen

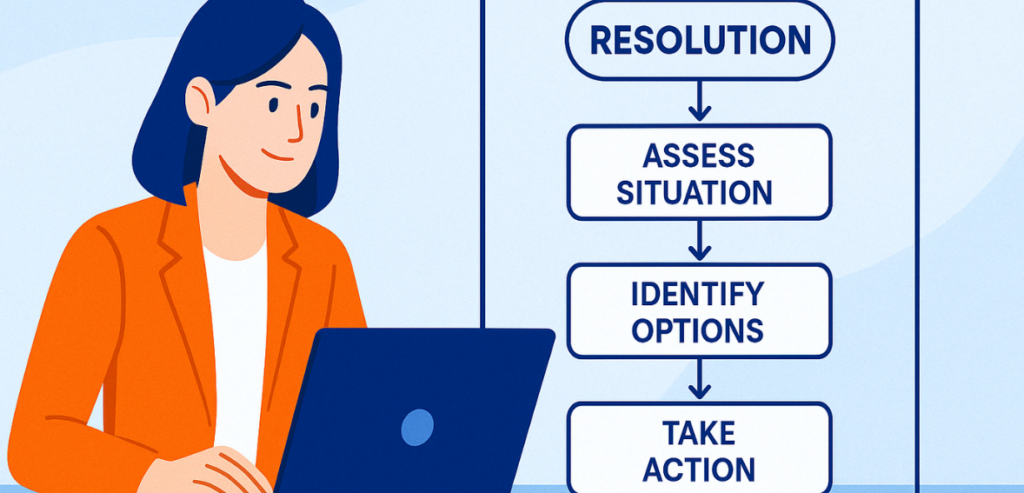

Finding your merchant account freeze necessitates taking action immediately because time is of the essence. Here’s what to do immediately:

Contact your payment processor support by calling their customer service or account representative department immediately. Have your account information handy as well as all applicable transaction data, when you report the freeze. Insist on precise information on why the freeze occurred and get step-by-step directions to resolve it from your representative. Ask for information regarding the timeline for resolution, then record the conversation history. Payment processors will typically reach out to you via notifications regarding the cause of the frozen account. Service restoration requirements, along with critical next steps, are found in the notification received from the communication channel. Carefully read all pages of this document before carrying out the outlined directives. Reach out to your account representative if you did not get any points in the communications.

Unfreeze the account but at the same time implement alternative payment systems to ensure business continuity. Your company may consider other payment options that include secondary processors electronic platforms, and ACH transfers, as well as digital wallets along with cryptocurrency options based on appropriateness. Pre-set alternative payment solutions before issues arise are ideal, but the instant setup of alternatives can reduce operational effects during interruptions. When companies inform consumers about payment process issues, this safeguards the level of trust with them. Inform consumers about offered payment options and keep the technicalities of how the accounting constraint works secret. The easiest would be to alert consumers to issues with the payment system and follow instructions regarding alternative payment solutions in a simply worded note.

Keep thorough documentation that documents all communication with your payment processor by writing down dates and times and capturing both representative names and discussion summaries. Your created documentation can be used as evidence if disagreements arise regarding the problem or if you have to pass the issue up to managers or regulatory agencies. Keep all chat histories and message logs, in addition to keeping written notes when talking over the phone.

Resolving a Frozen Merchant Account

Resolution can vary from days to weeks, depending on the cause of the freeze. The solution lies solely with the cause of the freeze. For suspicious activity indicators, submit proof of the validity of the flagged transactions. This can be invoices, ship confirmations, customer correspondence, or business agreements. Provide context for any unusual patterns in your transaction history with information regarding your business cycles or special promotions.

For excessive chargebacks, include a plan describing how you’ll minimize chargebacks in the future. This may include enhancing product descriptions, adding better customer service, using clearer billing descriptors, or updating return policies. Illustrate that you comprehend the issue and have actual steps to implement to solve it. For TOS infractions, illustrate how you’ve made changes to business practices to be compliant with requirements. If you have been selling illegal products or running your business in a prohibited capacity, demonstrate how you have shifted your business model to adhere. Occasionally, this may involve turning your product line or services on its head.

For compliance, provide evidence of having solved the particular compliance issues. This may involve undertaking a PCI DSS evaluation, taking necessary security steps, or revising your privacy policies and data handling practices. Payment processors often ask for particular documentation to authenticate your business and transactions. This may involve business licenses and registration proof, financial documents, transaction histories, identification verification documents, and evidence of product or service supply. Draw up these documents beforehand and present them in the desired format. Incomplete or unorganized documentation may slow down the resolution process.

Professional, routine follow-ups show the determination to solve the problem. Monitor case numbers and past communications to maintain continuity. Be careful, though, about not crossing the line from persistence to pestering. Ask your rep for routine follow-up times and follow their advice. If your account is still frozen after you have tried to resolve the situation, or if you feel the freeze was unjustified, it may be useful to speak with an attorney who handles payment processing or financial regulation cases. An attorney can advise you of your rights and options, such as possible appeals or formal complaints.

Managing Your Business During the Revolution Process

To unfreeze your merchant account, you will have to keep the business afloat and reduce financial impact:

Review your cash balances and adjust your budget to include potential delays in the receipt of funds. Consider whether you would require short-term credit facilities to cover any deficiencies. This could include business lines of credit, short-term borrowings, or factoring of invoices. Having an idea of what your cash flow needs for the next few weeks will allow you to determine what financial facilities you will need to draw on.

If the freezing of accounts will affect your ability to pay suppliers or vendors, inform them in advance. Most will work with you on adjusted terms of payment if you’re truthful with them. Keeping suppliers current is critical at this point. Make payments to critical vendors whose services or products are crucial to your ongoing operations.

Work harder to serve your customers at this time. Satisfied customers will be more willing to cooperate in payment trouble and less likely to demand refunds or chargebacks. Train your customer service representatives to accept questions regarding payment problems without sounding an alarm. Be extremely attentive in providing excellent service to cover up any inconvenience in making a payment. Consider short-term modifications of your business operations to reduce dependency on the frozen merchant account. This may involve promoting higher-margin goods or services, reducing orders for inventory, or holding off on non-essential spending until the crisis has passed.

Preventative Measures for the Future

Once your account is unfrozen, take steps to prevent problems in the future and enhance your payment processing infrastructure:

Do not put all your eggs into one basket. Having more than one provider translates to redundancy when one freezes your account. The diversification strategy should include various types of payment processors, ranging from normal merchant accounts, and payment service providers, to other payment methods. Each processor could have different levels of risk tolerances and requirements for compliance, providing you with options if there is a glitch with one of the providers.

Implement a proactive chargeback management system, including clear return policies, quality customer service, easy-to-notice billing descriptors, and timely order shipping. You may also want to use chargeback prevention tools offered by payment processors or third-party vendors. Chargeback prevention tools can provide you with real-time alerts of potential chargebacks, and you can thus resolve customer problems before they are escalated to formal disputes.

Periodically review and adhere to Payment Card Industry Data Security Standards, Know Your Customer regulations, Anti-Money Laundering requirements, and the terms of service of your payment processor. Be aware of updates to these requirements and modify your practices in response. If your business is in a highly regulated environment, consider the use of compliance consultants.

Utilize strong fraud prevention techniques for the protection of your business as well as your customers. This includes address verification, card verification codes, 3D Secure verification, and transaction monitoring systems. The cost of implementing these is typically far less than the cost of possible fraud and account freeze. Establish open communication channels with account representatives before there are issues. A good rapport can help to speed up resolution if there are problems. Dedicated account management is offered by some payment processors for merchants who have certain volume levels. If available, this service is a useful help in times of account stress. Check your merchant account metrics periodically, like chargeback percentages, transaction volume, decline rates, and customer complaints. Fix any suspicious trends before they trigger automatic alerts. Creating dashboards or scheduled reports for these metrics can allow you to catch issues early.

Choosing the Right Payment Processor

The process of choosing your merchant account provider for a new setup or post-freeze switch needs evaluation of multiple important factors for your business success:

Payment processors maintain concentration on dealing with industries with elevated risks. Research the payment processing providers who demonstrate the best knowledge of your business structure while maintaining experience in dealing with related industries. The specialty processors might cost more than others, yet they demonstrate greater reliability and specialized knowledge of industry problems. Choose payment processors that display their policies for account freezes and merchant account holds and provide information about the appeal procedures. Such transparent policies show that the processor maintains respect for merchant relationships and established processes to handle disputes. Exercise thorough examination of service terms before contacting the processor about your business concerns.

Every business needs immediate customer support when they encounter account-related problems. Check the service quality of providers through customer reviews before starting your business partnership. Choose payment processors that provide multiple access through phone calls in combination with email and live chat support and dedicated hours beyond regular business time for companies operating out of regular business hours. When evaluating costs among candidates, you should analyze both transaction and chargeback fees together with monthly payments and cancellation penalties. Cost awareness of processor operations allows you to select business-focused vendors who deliver optimal value to your organization.

You should examine both the integrative capabilities of the processor and its existing technology stack. A processor with seamless integration ability removes operational delays while delivering high-quality user interactions to customers. All these systems must integrate with your e-commerce system as well as your accounting system and customer relationship management system.

Learning from Experience

Account freezes are used by merchants as tough tests to discover useful business information while looking for areas for improvement.

Your experience should allow you to recognize both your financial risk profile and how this profile is perceived by lending financial institutions. The acquired information can inform future product choices and affect both pricing strategies and payment processing procedures. A professional risk assessment needs to be done to discover issues within your payment processing system.

Determine operational vulnerabilities in the freeze and incorporate improvements into the system. The firm should simplify fraud detection systems while redefining product definitions to minimize confusion and simplifying shipping processes to improve delivery speed.

Establish backup payment processing arrangements, as well as set funds that you can use in payment disruptions. Put these operational plans in writing and train key staff members who will carry out their activities when faced with the same payment disruptions during future emergencies. The effectiveness of contingency measures depends on its regular testing procedure.

This experience provides the opportunity to implement best practice training for payment processing for yourself and your staff. Exchange events and webinars are worth considering as tools that expose members to changing industry regulations and market trends in payment processing.

Conclusion

A frozen merchant account is a serious but temporary obstacle for your business. By understanding why it occurred, moving fast, and resolving it step by step, you can navigate through it with the least amount of disruption to your business.

Remember that prevention is always preferable to attempting to deal with a freeze after the fact. Compliance checks on an ongoing basis, diversified payment processing relationships, and proactive risk management can avoid future account freezes. Most importantly, use this experience as an opportunity to build a more resilient payment processing infrastructure in your business so that in case a similar episode is encountered again in the future, its impact will not be as experienced in your operations and bottom line. Proper planning and diversification will ensure that your business can overcome payment processing adversity and emerge stronger and wiser as far as this critical component of modern commerce is concerned.

Leave a Reply